Companies Need to Prepare for Policy Changes and Respond Proactively

Recently, the Nonferrous Metals Industry Association’s Aluminum Branch held a meeting, where it was stated: "Aluminum exports will remain at a high level in 2024, and the final decision on the export tax refund policy will impact the industry. Companies need to prepare for policy changes and respond proactively."

According to Aladdin's (ALD) recent tracking and research, many domestic aluminum processing enterprises are actively coping with the impact of the export tax refund policy adjustment. 13% of the export tax refund costs have been effectively passed on, progressing toward a positive trajectory.

Aladdin (ALD) has been continuously tracking the situation of new external orders for domestic aluminum processing companies and dynamically assessing the related impacts. Feedback from some companies that focus mainly on domestic sales indicates that, as of now, there has been no significant change in new orders for December, or even January 2025. Therefore, companies' assessments of the impact of the export tax refund cancellation remain somewhat insufficient.

In mid-November, we shared an "Overall Impact Assessment of the Cancellation of Export Tax Refunds." Based on our current tracking, we can roughly divide the situation into the following stages:

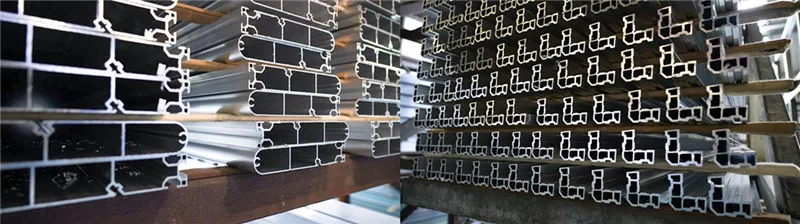

1. November's Rush to Export: This phase is essentially concluded. Whether it is aluminum sheet, strip, foil, or aluminum profiles in South China, the situation of rushing to export in November was common.

2. The Shrinking Period of New Aluminum Export Orders and the Contraction of Aluminum Raw Material Imports: Currently, both aspects are in a logical speculation phase, with data yet to be validated. The decision-making process by financial capital, whether bullish or bearish, has its own rationale.

3. The “Internal Competition” Period in the Aluminum Processing Industry and Response Strategies:

This will not only affect aluminum processing enterprises focused on exports but also domestic-focused aluminum processing companies, as both will face similar circumstances. The industry has already been highly competitive in 2023, and in 2024, it is likely to enter a period of elimination or industry consolidation. This may be what the Association referred to when it pointed out: "Companies need to prepare for policy changes."

4. Price Fluctuations in Raw Materials:

In our late November update, we shared our analysis on "Why the next three to four months will see complex factors influencing aluminum prices." We emphasized the numerous factors that will affect aluminum price fluctuations. For domestic aluminum processing companies, however, fluctuations in base prices have a more significant impact, and the high-level operations of raw material prices will also affect financing costs, financial costs, yield losses, and other aspects.